32+ deduction for mortgage interest

However higher limitations 1 million 500000 if married. Web The total of all the 1098s is 2779336 yet on my schedule A only 16242 is showing.

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

12950 for tax year 2022.

. Web 1 day agoOne of the major downsides of being self-employed is that you have to pay both the employer and employee portions of Social Security tax. Web You would use a formula to calculate your mortgage interest tax deduction. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

For 2022 the standard deduction is 25900 for married couples and 12950. Homeowners who bought houses before. Therefore the total itemized is below the standard.

Web If youve closed on a mortgage on or after Jan. Web The mortgage interest deduction applies to different types of mortgage interest including interest charged monthly as part of your regular mortgage payment and points paid. Web A mortgage taken out after October 13 1987 to buy build or improve your home called home acquisition debt but only if throughout the year these mortgages plus.

1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Web 23 hours agoWith todays interest rate of 712 a 30-year fixed mortgage of 100000 costs approximately 673 per month in principal and interest taxes and fees not. Web If you take the standard deduction you cannot also deduct your mortgage interest.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Most homeowners can deduct all of their mortgage interest. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing.

Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. When I zoom into the mortgage interest on the schedule A I can see all three.

Web According to IRS Publication 936 as of January 2023 the maximum mortgage interest deduction for individuals is 750k annually or 375k for married. Web Thank you for the response but the mortgage interest of 1439500 is reported as zero on schedule A line 8A. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household.

Web How much is the tax deduction can be applied for mortgage interest. Taxpayers are eligible to deduct the interest paid on. Web Standard deduction rates are as follows.

Single taxpayers and married taxpayers who file separate returns. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Take Advantage And Lock In A Great Rate. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. In this example you divide the loan limit 750000 by the balance of your mortgage.

Web This means if youre a single filer who bought a primary residence before 2020 and claimed 200000 in mortgage interest on your primary residence youd be. Web On his 2012 federal income tax return Brother C deducted 66354 of mortgage interest paid relating to the Paradise Valley propertyhalf of the total. Use NerdWallet Reviews To Research Lenders.

As each half amounts to. Web The deduction for mortgage interest is available to taxpayers who choose to itemize. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web The mortgage interest deduction is simply a tax deduction for the interest paid on your mortgage payment. When it comes to tax deductions for mortgage interest since the 2018 Tax Cuts and.

The Home Mortgage Interest Deduction Lendingtree

Free 31 Calculation Forms In Pdf Ms Word

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

Free 31 Calculation Forms In Pdf Ms Word

:max_bytes(150000):strip_icc()/InterestDeductions-0c6d98dac2c64b9a93c07d8078ae5fdd.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction Changes In 2018

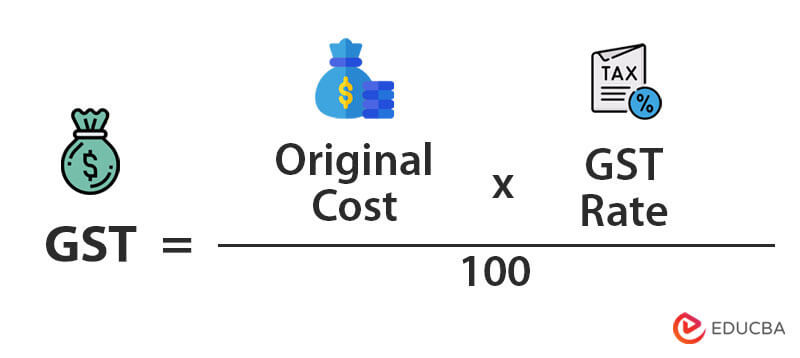

What Is Gst Types Rates Calculation Registration Examples

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Rules Limits For 2023

Economist S View Health Care Costs And The Tax Burden In The Us And Europe

Crain S Detroit Business Sept 5 2016 Issue By Crain S Detroit Business Issuu

Mortgage Interest Deduction Rules Limits For 2023

Mortgage Interest Deduction How It Calculate Tax Savings

Fixed Rate Mortgage Wikipedia

Lg Tone Free Dfp3 In Ear Bluetooth Headphones Eclipse Blue Amazon De Electronics Photo

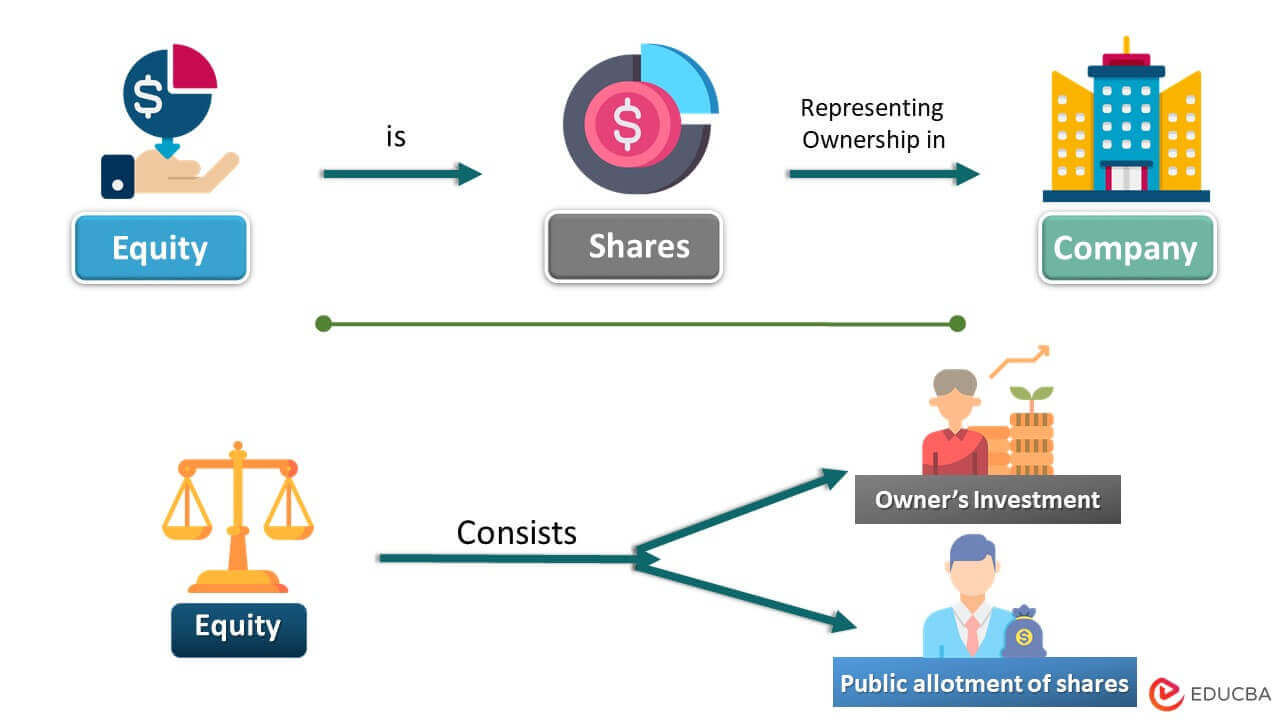

Equity Meaning Formula Examples Calculation Importance

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget